Wishfin

CIBIL Score Check App

Description of Wishfin: CIBIL Score Check App

Wishfin is an application designed to help users check their CIBIL Score, which is a three-digit number representing creditworthiness. This app is available for the Android platform and provides users with a range of features that enhance their financial management. With the ability to download the Wishfin app, users can access their credit score and monitor various aspects of their credit history.

The primary function of the Wishfin app is to allow users to check their CIBIL Score for free. This score is crucial for understanding one’s credit health, and the app encourages users to check it regularly, ideally on a monthly basis. The CIBIL Score ranges from 300 to 900, with scores of 700 and above being considered excellent by financial institutions. Users can gain insights into their creditworthiness, which can influence their ability to secure loans or credit cards.

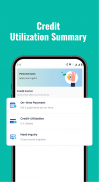

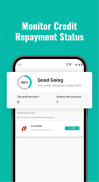

In addition to checking the credit score, the Wishfin app offers a detailed credit report. This report includes essential information about credit history, repayment status, and utilization of credit. Users can easily track their repayment status, ensuring they maintain a healthy credit profile. The app provides a summary of credit history, allowing users to see their monthly progress and any changes in their score over time.

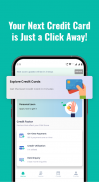

Another significant aspect of the Wishfin app is its capability to recommend financial products based on the user’s CIBIL Score. This personalized approach helps users identify suitable personal loans and credit cards that match their credit profile. The app features a range of personal loans from some of India’s top non-banking financial companies (NBFCs), including Tata Capital Limited, DMI Finance Private Limited, and IIFL Finance Limited. This variety allows users to compare different loan options and select the one that best fits their financial needs.

The application streamlines the credit card application process as well. Users can apply for credit cards directly through the app, with instant approvals available. The app simplifies the comparison of various credit cards, enabling users to explore the features and rewards associated with each option. This functionality enhances the user experience by providing a one-stop solution for managing both credit scores and credit applications.

Security is a priority for the Wishfin app, as all information entered by users is securely transmitted to TransUnion CIBIL. This ensures that personal data remains protected and confidential. Users can feel confident that their credit information is handled with care and will not be shared with third parties.

Monitoring credit utilization is another key feature of the Wishfin app. Users can track how much of their available credit is being used, which is an essential factor in maintaining a good credit score. By staying informed about their credit utilization, users can make better financial decisions and avoid potential pitfalls that could negatively impact their creditworthiness.

The app also provides insights into the implications of changes in payment modes or delays in payments. Users are informed about possible additional charges or penalties that may apply based on lender policies. This transparency helps users understand the importance of timely payments and the impact it has on their credit score.

For individuals who may be new to credit or have a limited credit history, the app offers support by explaining that a score of 0 or -1 is not necessarily indicative of poor credit health. Instead, it signifies a lack of credit history. Users are encouraged to start using credit products responsibly to begin building their credit score.

By downloading the Wishfin app, users gain access to a complete credit management tool. The user-friendly interface allows for easy navigation through various features, making it simple for anyone to track their credit score and apply for financial products. This accessibility is particularly beneficial for individuals seeking to enhance their credit profile or those looking to secure loans and credit cards.

Wishfin has established itself as a trusted partner in credit management, catering to a wide audience with its efficient and secure platform. With over 56 million customers and a significant amount of credit disbursed through its services, the app continues to grow in popularity among users seeking reliable financial solutions.

Through its comprehensive offerings, the Wishfin app not only helps users monitor their credit score but also empowers them to make informed financial decisions that can lead to improved credit health. By integrating various features into one platform, Wishfin provides a practical solution for anyone looking to manage their credit effectively.

For more information, users can contact Wishfin's helpdesk at +91-8882935454 or via email at appsupport@wishfin.com.